Retail Internet Banking FAQs

Equitas Internet Banking is a powerful tool that lets you do everything you want with your accounts at a click, giving banking in Real Time providing up to date details on your account. Move from traditional Branch Banking. No more waiting in long queues. Get to know what our Internet Banking has to offer.

Once you open an account with Equitas Small Finance Bank, your welcome letter will contain your Customer Identification Number, Account Number and also your Personalized Debit Card if opted.

For registration, you need to go to and submit the following details for registration {Under Sign up Now}.

Register with your personal details

Provide your Customer Identification Number (Customer Identification Number will be 7 digits & your A/c number will be 12 digits)

Mobile number

Date of Birth

Email ID

You will be receiving a One Time Password on your Registered Mobile Number.

Post receiving the OTP, you will have to select 3 different security questions and answers before proceeding with the selection of User Name / Password for the Internet Banking login.

Security questions & answers will be useful for you if and when you want to reset your Internet Banking credentials.

Register with your Debit Card

Enter your 16 digit Debit Card number

Enter the expiry date and CVV

Enter your ATM PIN

You will be receiving a One Time Password on your Registered Mobile Number.

Post receiving the OTP, you will have to select 3 different security questions and answers before proceeding with the selection of User Name / Password for the Internet Banking login.

Security questions & answers will be useful for you if and when you want to reset the Internet Banking credentials.

You are now set with your unique User ID & Password.

OTP refers to One Time Password. The OTP is valid for 5 minutes. One Time Password acts as a secondary authentication over and above your login ID and password for Online Banking. One Time Password is required for all key financial transactions and this will be a 6 digit number sent as an sms to your Registered Mobile Number.

Please note that every OTP comes with a unique Reference ID to help you enter the relevant OTP in case you have generated multiple OTPs for the same transaction. Reference number will be available on the mobile phone and on your Internet Banking / Mobile screen where the OTP has to be entered.

User ID should be a combination of alphabets and numbers. Maximum character length is 100 characters. Password should be a minimum of 8 characters and a maximum of 32 characters. The Password should be a combination of 1 mandatory upper case, 1 mandatory lower case, 1 number & 1 special character.

Your Internet Banking Password will be valid for 365 days and you will be asked to reset your password on and after the date of expiry.

Your User ID has no expiry date and once the User ID is set, the same cannot be changed for your account.

Check your account balances and review online statement for upto 3 months.

Book Fixed Deposit / Recurring Deposit

Redeem Deposits online

Recharge DTH / prepaid mobile

Request for a Statement / Cheque book

Download Periodic Account Statement

Update Profile Contact Details

Free Coupons for Recharge

Debit Card Pin Reset / Green Pin

Card Limit Management

Request Stop Payment of a Cheque

Hotlist your Debit Card

Register for Third Party Transfer

Transfer funds between accounts within Equitas Small Finance Bank and other Bank Accounts using RTGS / NEFT & IMPS

Set Standing Instructions

Cheque Deposit

Raise service requests / complaints

Equitas Internet Banking service is Secure. We use Industry-Standard Technology and Infrastructure. We ensure that your account details and transaction details are in safe custody. For your security, please read through the Do's and Dont's section. Our Internet Banking security consists of up-date standards for security as set by the Reserve Bank guidelines.

Don’t worry about remembering your password. You can always reset this at your convenience in easy steps. Our aim is to make your life simple and your banking experience fun.

You need to go to and select Forgot / Reset PIN.

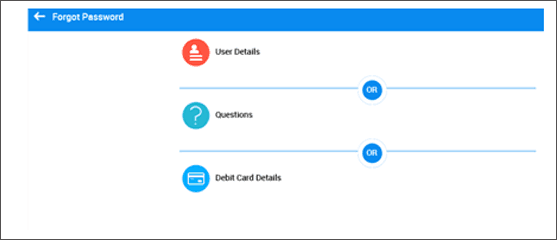

You can reset your password using your profile details, answering your security questions or by entering your debit card details – Remember to have your Customer Identification Number handy before selecting the option of user details / questions.

Once logged in, you can go to Profile settings and change your Password. It is advisable to keep changing your Password frequently. Your Password is valid only for 90 days.

There are no restrictions in the number of Beneficiaries that you can add on your account.

In your Internet Banking account, under Transfers, Beneficiary Maintenance, you can add or delete a Beneficiary. Once Beneficiary details are added, you will be requested to validate the same with a One Time password. You can choose to activate the Beneficiary based on your convenience. Once Beneficiary is added, there will be a cooling period shall be Applicable.

Only Beneficiary Account Number is required for Equitas Accounts. For Other Bank Beneficiaries, Account number & IFSC code of Beneficiary Bank needs to be entered. The Name off the Beneficiary shall be auto fetched.

Beneficiary Nick Name – You don’t have to remember the actual name. Create your own nick names for friends / family or anyone that you want to transfer to.

Once a Beneficiary is added, the transfer limits permitted are as follows

| First 30 minutes | Upto Rs.20000 |

| First 24 hours | Upto Rs.100000 |

| Beyond 48 hours | As per the transaction limits. |

When your account is opened, our staff would have your picture taken. The same picture will come as a direct feed to your Internet Banking account and this may not be changed at this stage.

Customer may place a request for disabling retail internet through CCC (Customer contact centre) and Branch channels.

View your Account balance

View your Account statement

Enquire about cheque status

Request for a statement

Downloadable online statement

Download Periodic Account Statement

Update Profile Contact Details

Free Coupons for Recharge

Debit Card Pin Reset / Green Pin

Card Limit Management

Request for a cheque book

View your Fixed Deposit details

Download your Fixed Deposit Advise online.

Update your profile

View your Mandates

Offers from our side

Change Deposit maturity instructions

Customizable limits for your fund transfer

Maximum NEFT limit – INR 2,00,000 per transaction.

Minimum of INR 2,00,000 & Maximum RTGS limit – INR 10,00,000 per transaction.

There are also restrictions during the first 24 hours of adding a beneficiary, the applicable limits will be displayed when you are attempting for a fund transfer.

Under profile settings you can choose to reduce your daily limits for online transaction (NEFT / RTGS / Within Equitas / IMPS / Outside Equitas). The maximum threshold set by the bank will remain unchanged.

Do’s:

Make net banking Passwords difficult to guess by using strong 6-8 length alphanumeric characters.

Change your Password at regular intervals.

Set Secret Questions and Answers to ensure that you can reset the Password online.

Update the latest Mobile Number and E-Mail id with the Branch.

Equitas Small Finance Bank sends you all your transaction alerts and transaction related authentications (Eg. One Time Password) on your Registered Mobile Number.

Keep a track of all your transactions done in account regularly.

Use recommended Standard Safe Web browsers like Internet Explorer 7.0 and above.

Log off from the Internet banking when your session is finished. Clear the Browser level Cookies, Cache and Saved Passwords from the browsers.

Use licensed anti-virus software on your computer, and ensure it is regularly updated.

Use a browser version that is EVSSL compatible, which will help you easily identify genuine websites.

Dont’s:

Do not share Login User-ID , Password, Digital Signature Certificate and the PIN associated with the Digital Signature Certificate to anyone including family members, friends or bank employees.

Do not write down Passwords, PIN on any paper which may be seen easily by anyone.

Never note down User ID, Password on a piece of paper, documents or phones for easy retrieval.

Customers should also never use the ‘Remember Password’ feature provided by browsers to save their Net Banking Passwords.

Don’t share your Password or CVV details to anybody. The Bank never asks for confidential information like User ID, Password, ATM Card Number, CVV, etc., via mail, SMS or bank initiated phone calls.

Do not store confidential information including your account details and Passwords (Including One Time Password) where they are easily accessible. Common incorrect practices followed are storing information in a file on your computer, laptop or phone or saving them under unprotected notes.

Password protects your pc, laptop and mobile device to prevent unauthorized access and avoid using unsecured or shared networks.

Avoid using your Internet Banking or making payments through Internet Banking from shared or unprotected Computers/ Smart Phones from public areas.

TDS refers to Tax Deducted at Source. Under your Internet Banking, if you hold any deposits, the tax computation of the TDS for the Deposit will reflect online. Under certain conditions, the customer can request for TDS exemption basis valid proof submission

– The proofs can be uploaded online.

Cheque book request

Statement Request

Demand Draft

Standing Instruction

Your Internet Banking account will be idle upto 5 minutes for inactivity. Post 5 minutes, the session will be logged out and the user needs to login again.

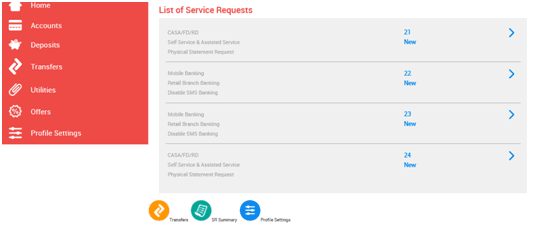

SR Summary Refers to Service Requests. Any requests placed online will generate a Service Request for the bank to action upon. The status of your request will reflect under the SR Summary section.

You can set a Standing Instruction for triggering fund transfer to a beneficiary within Equitas. The frequency of the fund transfer can be set for daily, weekly, fortnightly, monthly, bimonthly, quarterly, half yearly and yearly.

You can call our call center on 1800 103 1222 or register your complaints via Online Banking. Go to Utilities and lodge your complaint online. You can always visit your nearest / home branch for any assistance during business hours.

Items in pipeline that will be coming soon via Internet Banking are….

Unified Payment Interface

Payment Gateway Integration

Loyalty Rewards solutions

Merchant Transfer

Cheque Pickup facility

Enabling and disabling Point of Sale and online transactions of your Debit card

Rewards, cashback & Redemption

Once you perform a fund transfer, you can choose to save the transaction under favorites. Once saved, you can access the same from main page under favorites and the saved beneficiary and transaction mode will be auto populated for you to complete your fund transfer.